The latest steel structure design standards today

The latest steel structure design standards today

Although there are still many challenges to face, there are more positive signs for the steel industry towards the end of the year, coupled with expectations of a demand recovery in some Asian countries in the near future, which will support the domestic steel sector.

10/01/2023 08:24

According to the statistics from the General Department of Customs, Vietnam exported 823,128 tons of steel in December 2022, marking a 40.2% increase compared to the previous month.

According to the statistics from the General Department of Customs, Vietnam exported 823,128 tons of steel in December 2022, marking a 40.2% increase compared to the previous month.

According to the Vietnam Commodity Exchange (MXV), with the strong recovery trend in global steel prices over the past two months, domestic steel prices in Vietnam have also begun to show signs of increase. Last weekend, many steel companies adjusted prices upwards for some types of steel. Notably, CB240 rolled steel saw a simultaneous price hike, with the Hoa Phat Group raising the selling price of this type by an additional 200 VND/kg to 14,940 VND/kg.

The situation regarding Vietnam's steel exports in the final month of 2022 has also shown more vigor. According to the statistics from the General Department of Customs, Vietnam exported 823,128 tons of steel in December 2022, which is a 40.2% increase compared to the previous month. The export turnover also increased by over 24%, reaching more than 584 million VND.

In December, Vietnam continued to have a steel trade deficit of over 123,000 tons. However, this trade deficit also significantly decreased compared to the figure of approximately 376,000 tons in November. Thus, considering the entire year 2022, our country has returned to a steel trade deficit of over 3.3 million tons, after recording a trade surplus for the first time in many years in 2021. Despite still facing many challenges, there are more positive signs for the steel industry towards the end of the year, along with expectations of a demand recovery in some Asian countries in the near future, which will support the domestic steel sector.

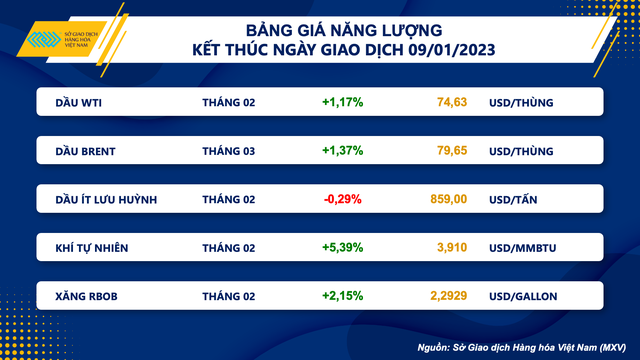

Energy price list ends on January 9.

World oil prices are rising in anticipation of a resurgence in fuel consumption.

Oil prices are increasing as China's reopening reinforces the prospects of fuel consumption. At the close on January 10th, the WTI crude oil price rose by 1.17% to $74.63 per barrel, and the Brent crude oil price increased by 1.37% to $79.65 per barrel.

The world's largest consumer has recently issued a new quota of up to 111.82 million tons for oil importers. As of this week, China has issued a total of 132 million tons of imported crude oil quotas in two separate quotas for 2023, surpassing last year's 109 million tons.

According to MXV, fuel consumption is expected to improve somewhat during the upcoming Lunar New Year holiday. The relaxation of the "Zero Covid" policy has ignited the recovery of the world's largest domestic aviation tourism market, with Tet holiday bookings potentially reaching their highest level in three years. Officials also estimate that the number of holiday trips will reach 2.1 billion, double last year but still only 70% of 2019.

However, analysts believe that China's oil consumption demand will truly recover strongly from the second quarter when the number of infections has peaked, and production and construction activities have resumed.

On the Russian front, the country's leading Urals crude oil is currently being sold at a discount of up to 50% compared to Brent crude oil due to the impact of G7 sanctions and the pressure to lower prices to compete with shipments from the Middle East when selling to Asian partners.

Meanwhile, Kuwait is planning to enhance its exports of diesel and aviation fuel to Europe this year to make up for the gap left by Russia. Specifically, the Middle Eastern nation is expected to increase diesel shipments to Europe to 2.5 million tons, five times more than in 2022, equivalent to about 50,000 barrels per day.