Iron and steel exports flourished

Iron and steel exports flourished

Iron and steel exports flourished

(Chinhphu.vn) - Vietnam Commodity Exchange (MXV) said that the prices of basic metals are gradually receiving signs of improvement after a period of pressure from both macro factors and demand. actual consumption demand.

Compared to the same period last year, iron and steel exports from February 1 to February 15 this year have doubled.

It is likely that this positive trend will be maintained in the near future, especially with the need to fill reserve warehouses to serve the positive outlook for demand in the Chinese market. Real estate in China is also showing signs of stabilization, which will be a bright spot for the consumption of metals in the construction sector, thereby supporting copper or iron and steel prices.

In the domestic market, according to statistics from the General Department of Customs of Vietnam, in the first 15 days of February, our country has exported over 303,000 tons of various types of steel, generating a revenue of 227.5 million USD.

Compared to the same period last year, steel exports from February 1st to February 15th this year have doubled. The export value has also increased by a significant 63.5%. The booming export signals bring more positive expectations for the domestic construction steel manufacturing industry.

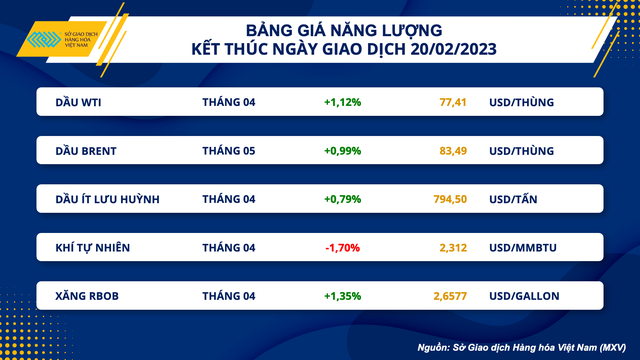

Energy price list ends February 20.

World oil prices rebound

Oil prices returned to the green in early-week trading, thanks to optimism about China's demand, along with major producers continuing to limit production and plans to restrain supply from Russia.

At the end of the session on 20/02, WTI crude oil prices rose by 1.12% to $77.41 per barrel, while Brent crude oil prices increased by 0.99% to $83.49 per barrel.

Due to the absence of activity from the US market during the holiday season, market liquidity decreased significantly. However, buying power still prevailed as analysts expected that China's oil imports would reach record highs in 2023 to meet the increasing demand for oil products.

Bloomberg estimates that demand from China will increase by 800,000 barrels per day, reaching an all-time high of about 16 million barrels per day this year.

The prospects for consumption both domestically and abroad have prompted Chinese oil refineries to increase crude oil processing capacity from 850,000 barrels to 1.2 million barrels per day. In addition to capacity expansion, at least two refineries with a total capacity of up to 520,000 barrels will go into operation in the coming months. These moves reflect that supply is increasing positively to meet consumption needs in the near future and are also the main supporting factors for the oil market in the previous session.

Investors are also paying significant attention to Russia's crude oil supply in the context of the country struggling to adapt to sanctions. The risks to future supply are also increasing as the United States plans for a new round of sanctions against Russia through new export control measures.

Currently, Russia plans to cut 5% of its oil production, equivalent to about 500,000 barrels per day. However, prior to this point, Russia's offshore crude oil exports have increased by 25% to 3.6 million barrels per day in the week ending on 17/02.

Vietnam Commodity Exchange (MXV)